•Exorbitant development contributions proposed

•Disconnect between Council and developers in Auckland

•Red zones emerging for sewer and fresh water making sites non-developable

•Abuse of monopolies by local government and utility providers

•Concern this will spread across New Zealand to other councils

I have noticed many of our property developer clients complaining of what they called "abusive costs" proposed by Auckland Council, Watercare/Veolia and Vector, so I reached out to a friend of mine, Kirsty Merriman, who is one of the administrators of the Subdivision NZ Facebook page (with 15,000+ investors on it).

Video: Kirsty and I recently held a webinar on the topics covered in this blog - scroll to the end of the article to view it or click here.

Background understanding

But first, we are talking about property development, which involves a lot of lingo around consenting.

The development process involves six crucial early stages: site purchase, town planning, civil engineering, resource consent lodgement, resource consent decision (RC), and finally, building consent (BC) and engineering plan approval (EPA).

Auckland Council levy and administrate Healthy Waters, which is stormwater (the water that comes off roofs, paths and driveways). Watercare/Veolia are in charge of sanitary sewer and drinking water. Vector supplies the power, and Chorus supplies telecommunication connections.

I note that most developers seem okay with Chorus but are frustrated with the rest. Veolia administrates the water network in Papakura, and they are particularly aggressive in their charges; clients have shown me some extraordinary demands from them that stop development, making it non-feasible.

The following is a precis of my interview with Kirsty, revealing what many describe as predatory charging, and proposed high costs that will undermine the development of small houses in Auckland if it continues.

INTERVIEW WITH MATTHEW GILLIGAN AND KIRSTY MERRIMAN

The proposed development contributions – absurdly expensive

Matthew Gilligan: Auckland Council need to pay to upgrade and increase the infrastructure somehow. What are Auckland Council infrastructure charges, and what are they proposing for development contributions?

Kirsty Merriman: Infrastructure charges are fees developers (the conduit) pay when connecting into city or town services, such as water supply, stormwater, libraries, parks, and transport.

There are two types of growth charges.

•Development Contributions (DCs) paid to Council of $20- $40k per dwelling depending on their location, size and typology

•Infrastructure Growth Charges (IGCs) paid to Watercare/Veolia of $21,000 per connection

On average, these charges total between $40,000 and $61,000 for one new house.

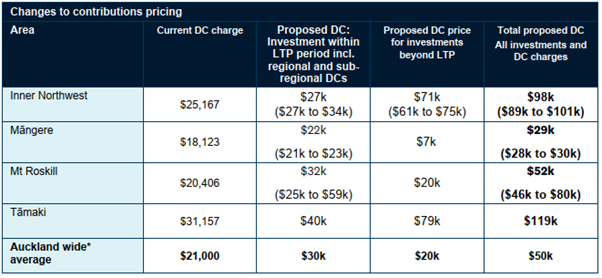

Council is proposing massive hikes in DCs for 2025; roughly 200-400% increases for some areas from March 2025. Tamaki, historically an affordable housing area, currently pays $31,157 [Image 1]. The proposed new charge is $119,000 – nearly a 400% increase. This is a total of $160k including GST per new regular standalone or duplex home. This is about half the cost of the building the home itself. Supply will crash because there will be no margin for the developer. I can assure you that developers won’t work for free, and they can earn more by putting their money in the bank!

Image 1: Auckland Council’s 2025 Proposal

Explanation of the columns above:

•Column 2: Development contributions as they are now

•Column 3: Contribution towards cost of infrastructure planned over the next 10 years

•Column 4: Contribution towards possible future infrastructure (i.e. a wish list of projects that may or may not be completed over the next 10-30 years)

•Column 5: 10-year planned infrastructure (what needs to be done), plus the wish list of projects that may (or may not) happen from years 10 to 30

Under this proposal, today’s developers are going to be asked to pay for the next 30 years of infrastructure, much of which is not certain or well explained.

In Papakura, each new house pays $24,000 for their stormwater contribution. The Council is spending $100 million on the Awakeri Wetlands project (swamp draining), meant to serve the area for 30 years. At current building rates and with the past stormwater recovery anomaly (where they had been applying an unequitable charge to small houses, treating them as if they were very large houses), they may collect this entire amount in well under 10 years.

The project also raises questions. While labelled as stormwater infrastructure, it seems to also involve converting flood-prone swampland into land suitable for new residential housing (which in and of itself is not a bad thing). However, This dual purpose raises a key question: should new homeowners pay for transforming unusable land into developable land? Surely their stormwater development contribution should be linked to the demand they create because of the extra ground their new housing covers.

A 10-year recovery time horizon seems to run against the principles of the Local Government Act. Council must spread the cost over the capacity life of the asset. Surely these assets or capacity should have a life span of beyond 10-30 years. I would prefer far more clarity around the costs and objectives.

Auckland Council is particular about saying developers pay. Actually, developers only pay if the project is viable. Levying such astonishing costs on developers results in developers not proceeding until they can pass the costs on to the home buyer. It is the home buyer that pays.

At face value, here's how these increased costs would look for a new home in Tamaki:

Image 2: Proposed development contribution costs example

This profit is before interest, bank fees, contingency costs, and tax. No banker will advance money on such low profits, and no developer would accept such a small return – it's far too risky. Supply will stop at these levy rates.

These costs will crash development and end the supply of affordable houses until there is sufficient house price inflation to cover them. Council’s own policy advice says this (Auckland Contributions Policy 2022 Var A, page 31). They are aware of the impact, but it reads like they don’t particularly bother with the impact because it increases cashflow.

It is inferred that the inflationary impact of constrained supply (from non-viable development) will push house prices up and then Council will get the money. But this is what leads to housing crises. Why not spread the cost over 30 years or 50 years? I know there is a debt carrying issue and permissions, but at what cost?

This is complex; a lot of knowledge is required even to create these high-level numbers. Being so hard to understand may give Council and other suppliers a free run. Many journalists, politicians and interested parties can’t seem to pull this together and see the big picture. The situation is accepted and most think that it’s developers who are rich and “have to pay their share”. Absolutely, growth needs to be paid for through growth charges, but they must be spread over the capacity lifespan of the asset. Why should infrastructure used by four generations be paid for by just one?

Recently I found the Property Council’s submission on the previous Policy. They also raised similar significant concerns: the policy is difficult to understand, the use of assumptions is less than clear, there are intergenerational equity issues, and they also disagree with the Council’s claims that the DCs don’t really influence house prices. Their report sates: “the net effect of increasing DCs is that housing affordability reduces in Auckland”.

Should infrastructure built to serve four generations be paid for by just one using estimates that are not well explained?

Should today’s builds pay for the under-investment or mistakes of previous generations?

This price of new housing directly affects the price of second-hand housing. It is all linked.

Matthew Gilligan: So DC increases will likely crash supply of small houses in Auckland.

Kirsty Merriman: Yes, I think so.

Matthew Gilligan: How can Auckland Council justify 200-400% increases?

Kirsty Merriman: The Council clearly needs funds to pay for expanding an overburdened network. There was a construction boom once the Unitary Plan came in and I suspect (based on Watercare’s 2024 revenue) it was more than expected.

In Tamaki, they want to redo the stormwater network, including improving the current system to greenfield quality, mostly paid for by new housing contributions. Private developers are unlikely to build there because they can’t pass on such a huge added cost, so the infrastructure probably won’t go in, supply will plunge, and bingo – house price inflation. It is self-limiting.

In other countries like Australia, these costs get put into a scheme where the Council borrows, and users pay as they connect. Such infrastructure has about a 100-year life span. Why don't we have something like that, or use targeted rates?

It looks like Council is attempting to fund 100-year assets over a mere 10 years (possibly 30 in select cases); they want today’s generation to pay for the benefits of the next three generations and are seeming to be a bit ‘loose’ with the details.

Developers are already talking about leaving. There are areas like Takanini, where there are empty development sites, and good homes are under pressure.

Matthew Gilligan: They know they are making developments non-viable. They don’t seem to care about disruption to supply, or the devaluation of land that results in the short-term. I can only imagine what will happen to the money collected for projects 10-30 years out – I bet it won’t be quarantined; it will be spent elsewhere.

Overcharging by monopolies

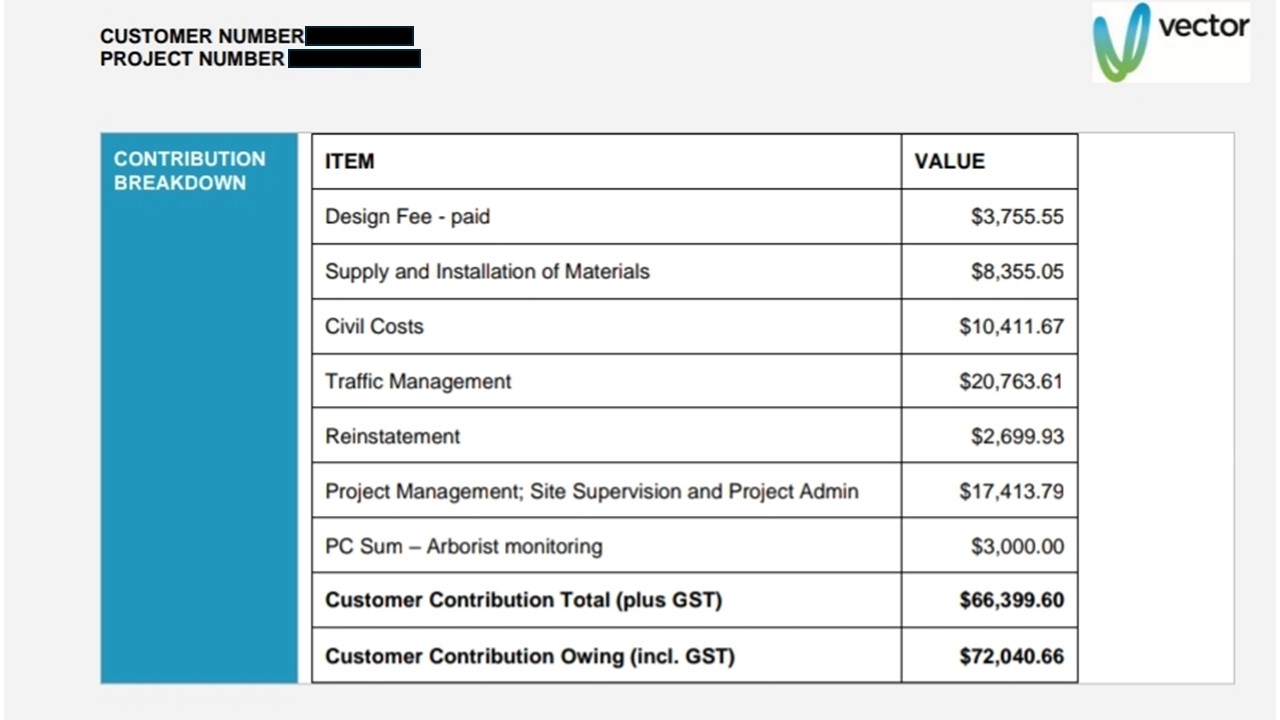

Matthew Gilligan: You suggest Auckland Council and Vector may have been overcharging – can you elaborate?

Kirsty Merriman: There are so many examples. Try this: Vector quoted $72,000 to move a box 20cm to make way for a fire exit. The box only serves the developer’s site, but Vector’s solution included putting in a new footpath, $20,000 of traffic management, and a $17,000 project management fee, among other things. The client had paid the design fee already but wasn’t happy with the rest, so got his construction team to move the box instead. This took them all of 90 minutes. Cost? A two-hour session of beers for the construction workers.

Image 3: Vector’s quote

Image 4: The box that needed to be moved 20cm

Recently, the owner of a single relocated house was asked to pay $55,000 to replace a full public power line. The owner’s choice was to insulate the walls or replace Vector’s asset.

One developer emailed me furious because Vector quoted $10,000 for traffic management. The developer arranged their own and paid $1,600.

There are so many like this. And when people get quotes from private contractors for power connection work, it’s usually 50-75% cheaper. But most people don’t know they can do this. Are Vector abusing their position?

Matthew Gilligan: These charges are absurdly expensive on Vector’s part. Developers can’t be expected to continue developing if they are facing costs like these.

Auckland infrastructure undersupply

Matthew Gilligan: As far as infrastructure goes, Auckland is woefully undersupplied. Many Auckland areas are being effectively red-zoned for development by Watercare and Veolia.

Kirsty Merriman: Currently it’s a perfect storm. Our infrastructure systems are struggling to keep pace with growth, including pressure for even more intensity from central government. Communications also appear fragmented – there has been a seeming mismatch between Auckland Council’s resource consent approvals and Watercare’s (and Veolia’s) available capacity for service supply.

Areas of Auckland have been effectively 'red-zoned' due to infrastructure constraints – often after developers have already invested significantly in the consenting process and had their resource consent approved (creating an implied expectation that all is okay).

We've seen many of these engineering plan approvals (EPAs) being declined after resource consent approval. This indicates the system lacks coordination. Surely the Council's engineers consulted the water teams, or at least would have known of the constraints. It appears not – the Council granted RC, but it was subsequently denied at the EPA stage.

Interestingly, one developer even told me that they were allowed to proceed if they paid an extra $5,000 per house – their EPA was approved. How is such an arbitrary charge levied and on what grounds?

Another was given an option to proceed if they installed 1.2 km of water line costing circa $1.6 million for four houses in Papakura (mixed housing suburban zone). Another reported a three-house development needed to spend $880,000 on public pipework. Veolia seem to have no regard for the principles of the Local Government Act 2002 (LGA) that says costs should be spread over the capacity life of the asset, not over one year or right at the start.

Matthew Gilligan: So even if they have a current resource consent, a developer's project may not be able to go ahead? Developers are being blindsided, having invested huge money into further design only to find their land is undevelopable, and they face capital loss because of red zoning.

Kirsty Merriman: Yes – including some Kainga Ora projects. I know of some developers who’ve spent well over $100,000 on further design work, relying on the undertakings in the approved RC that services are available.

Various zones are now at capacity. Areas within Auckland City, but excluding Papakura, have recently had capacity maps published by Watercare. We knew that the Otara/Papatoetoe wastewater catchment was constrained, parts of Papakura and New Lynn, and possibly parts of Birkdale and Botany. But what we got was vastly greater area constraints than those areas. It was devastating for many.

Developers confirmed in droves that they had been refused services. Kind of like a ‘tough luck, we don’t care’ attitude from Watercare.

Even as the red-zoning was raised to Watercare in October 2024, they denied it, despite developers receiving letters declining network connections. One person recently described these as “Dear John” letters.

The issue I have with this has been the lack of transparency. Developers have been wasting money on sites for the past year – paying premiums to buy what turns out to be non-developable land. Then they paid for expensive consenting processes, including answering questions for their EPAs, for projects they were then told could not proceed.

But there is some light now. While we can't change the physical infrastructure constraints, Watercare has finally listened to the public and made their previously concealed red zones available to everyone. This happened on 14 November 2024. By showing constraint areas it means fair decisions can be made moving forwards. This is what we were after: disclosure.

Interestingly, I was recently reading Council’s infrastructure response to the major plan change (PC78) that central government wanted. They were pushing for even more intense residential infill development. In their response, the Council said they had infrastructure constraints in certain areas, mostly in areas currently zoned for single housing (which is predominantly why they were zoned single house in the first place). They then went on to say that it is during the RC process that they assess infrastructure servicing and its affects. Looks like a broken process to me where the RC was issued and the EPA declined (one part of Council says yes, and other part says no).

Zoning is what developers were able to follow, and it should have been up-to-date with infrastructure capacity. Houses in single zones can’t really support in-fill and those in other areas can. You simply can’t build more houses without the pipes and connections available.

In that same response to the PC78, the Council said that these areas should be identified through ‘a mapping layer’, as it is the best method to manage ‘potential adverse effects’ from further intensification. To me it looks like Council knew this critical information wasn't available to developers. Did Council sit on this information for well over two years without checking back on achieved growth versus capacity? Why let this happen when there is so much talk about affordability?

From what I have seen through our large network of developers, those with approved resource consents (and I hope those with lodged consents) can take their EPAs back for reconsideration and site-by-site investigations. Those who have not lodged will have to work through their options, and it looks like Watercare have opened a constructive process for this. While there is currently quite a bit of panic and harm, it is now out in the open and plans can be made with no more developer money thrown away.

Unfortunately, Papakura remains a ‘Darkland’. How on earth can that be allowed? Someone must act on this.

Did you know that the 2024 Watercare annual report says they received $28.8 million in growth revenue over budget. I see two things from that: one, they didn’t expect the number of new houses that were built, even though they should have had the numbers; and two, there was a surplus, so why has the $27 million Otara upgrade not started? The Otara-Papatoetoe area had 1,563 new dwellings over the previous two years – this will have contributed about $24 million. Where did the money go? We need oversight on the way funds are sourced and applied in local council and utility providers; it is not adding up.

SUMMARY

The current red zoning due to inadequate infrastructure is going to crush new housing supply. Consented developments have been stopped in their tracks. Hundreds of thousands of dollars thrown away.

Why was Auckland not ready?

And then there was PC78 wanting cities to impose further intensity. At least it was delayed and is not operable.

And why did Watercare deny that ‘red zones’ exist? Why approve a consent declaring there is capacity available when it is not?

Auckland Council is struggling with infrastructure funding and is trying to fix it it by forcing developers to pre-fund 30 years of infrastructure over 10 years. Our children and grandchildren will have their infrastructure paid for in full by new home buyers today, if this occurs. Projects will become non-viable and construction will crash to a halt in areas like Tamaki and Inner North West. Are we looking at a self-inflicted housing crisis?

Longer-term projects should be centrally funded, or ‘socialised’ over a much longer term, matching the lifecycyle of the asset and the users connecting to it.

Those out of Auckland should not rest easy either, thinking this is just an Auckland problem. It will spread.

Developer action - Subdivision Advocacy NZ Limited (SANZ)

Some concerned developers have joined up and formed an organisation to track the more extreme cases of overcharging and red zoning. Both Kirsty and Matthew are part of this not-for-profit, public action group. Developers can submit their case online at www.sanz.nz. SANZ will bring it to the attention of central government, and has access to litigation funding options for class actions.

Matthew Gilligan

Managing Director and Property Services Partner

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

The seminar last night was the best I have attended. Your speech was inspiring, professional and interesting. I have followed GRA for a very long time and really love your books Property 101 and Tax Structures 101. I didn't find them in the library of Victoria University and managed to ask the uni to purchase some copies so that students won't miss out these amazing books. - Kardy - December 2017

Gilligan Rowe and Associates is a chartered accounting firm specialising in property, asset planning, legal structures, taxation and compliance.

We help new, small and medium property investors become long-term successful investors through our education programmes and property portfolio planning advice. With our deep knowledge and experience, we have assisted hundreds of clients build wealth through property investment.

Learn More