With interest rates showing signs of decline, investor interest in the property market may be on the rise. As lending rates fall, the cost of owning a home often becomes more competitive with renting, a trend that could drive a shift in New Zealand’s housing landscape towards more homes being purchased for rental investment and home ownership.

Notably, for much of 2024, the Reserve Bank of New Zealand (RBNZ) held the Official Cash Rate at 5.5%, and only started to reduce it slightly in August. Analysts are forecasting aggressive rate reductions in November and through 2025. If this trend continues, it will create a favourable environment for buyers, especially as the cost-benefit of ownership strengthens over time.

AUCKLAND

Historically, Auckland has been the gold standard of places to invest in property in New Zealand. Demand has been strong, capital growth excellent, and rents high. However, the dynamics are changing. With Auckland becoming so expensive, people have been moving to the regions and the shine is coming off Auckland from an investor’s perspective. I say this because Auckland has had the Unitary Plan operating for eight years now, and we have a lot more supply (especially of small houses). With over-supply comes decreasing rents and house prices. With immigration falling in 2024 from the historic peaks of 2023, we are seeing rents ease and house prices remain soft.

A spanner in the supply chain has recently emerged, though. Watercare (who deal with sewer) have red-zoned large tracts of land in Auckland, effectively stopping development in its tracks for many parts of Auckland. New Lynn, Glen Eden, parts of Waitakere, Otara, Papatoetoe, Manurewa, and parts of Drury are areas among those affected. This is effectively a ban on development, as consenting stops if you cannot connect to sewer due to capacity constraints.

In other parts of Auckland, controversial increases in development contributions are proposed by Auckland Council. For example, an egregious increase of $88,000 + GST, which will take development contributions from $31,000 + GST to $119,000 + GST, is proposed for the Tamaki area. This will effectively stop the development of small units if this cost comes in. Inner Northwest has a similar extortionate increase.

All this adds up to changing times in Auckland. Make sure you do your due diligence if buying property here; the red-zones and non-viability of small units (if the new development contribution charges come in) have the prospect of devaluing land.

Possible oversupply

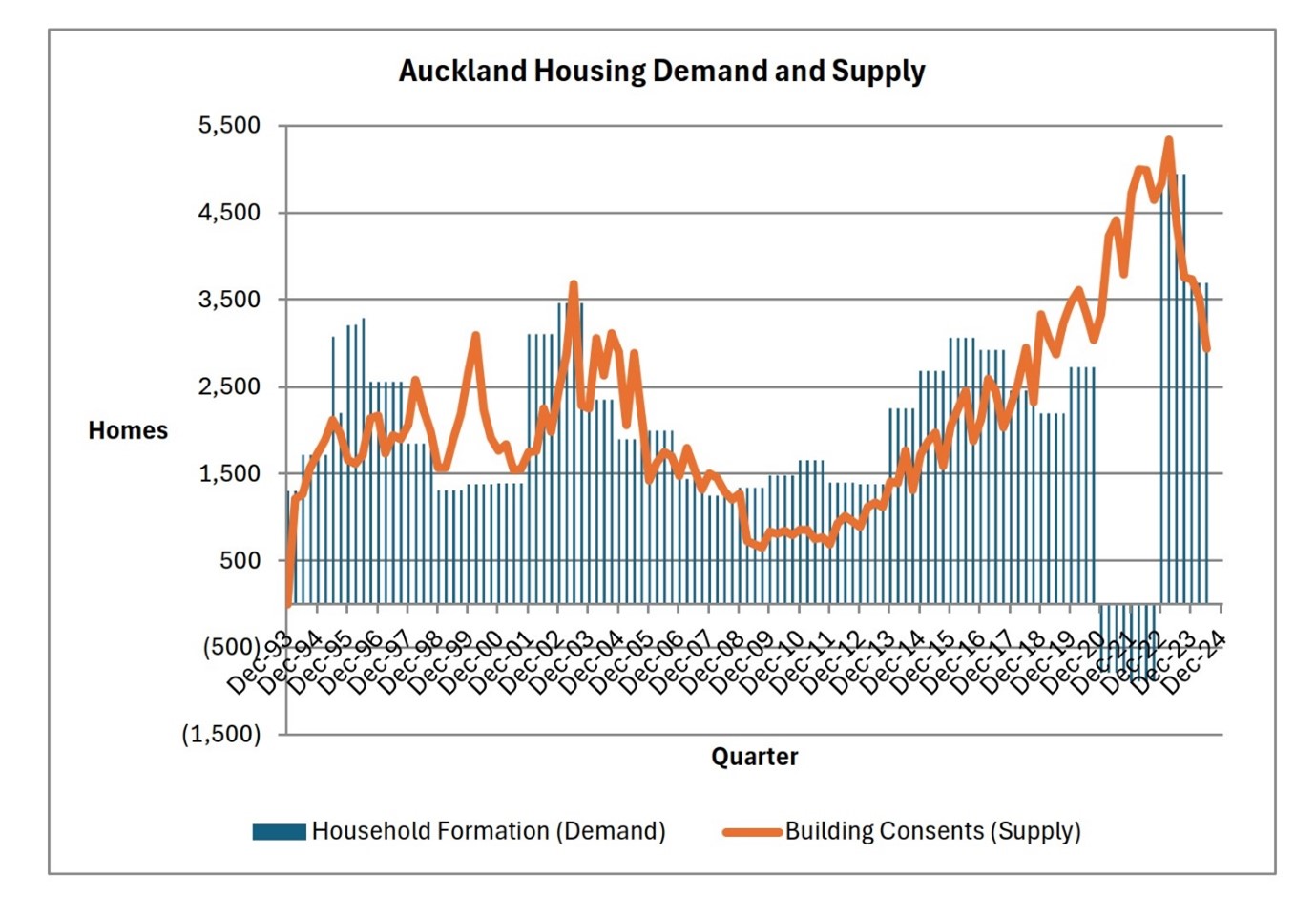

It looks like Auckland is facing a housing surplus as building consents outpace population growth. Take a look at household formation (population increase divided by three people per household = household formation), graphed against building consents. In recent years, we have been making too many houses, and its feels like it when you look at the increase in accidental landlords, and overhang of unsold stock on the market.

© Gilligan Rowe & Associates, LP 2024

Note, the graphs we have created for other areas, such as Hamilton and Tauranga, show the reverse of the Auckland one (i.e. demand outweighs supply).

REGIONAL MARKET STRENGTH

Regional markets in New Zealand are showing strong potential, with house prices in smaller towns being significantly lower than in Auckland, while rents ae often comparable. For instance, I recently purchased a home on a large site in Rotorua for $360,000, and invested an additional $50,000 in renovations. The property now rents for $575 per week, delivering a high yield and land banking potential for future development (I can put two freestanding houses in the back yard).

While Auckland faces affordability challenges and lower yields, regional areas offer attractive alternatives for both rental income and capital appreciation in my view, and are a much better bet than they were 10 years ago when the regions were over-supplied.

Regional rents catching up to Auckland

Over the past decade, regional rents have increased substantially, nearing Auckland's rental levels. In 2013, Auckland’s rental rates were considerably higher than those in smaller towns, but a decade of rising demand has absorbed surplus housing in the regions, driving rents to a comparable range while still offering lower entry house prices for investors. This shift underscores the potential for rental yield in the regions, allowing investors to achieve similar rents to Auckland, but with half the capital outlay.

Key considerations when investing outside of Auckland

Investing beyond Auckland can be lucrative, provided you select areas with diverse employment opportunities, tight housing supply, and rising population. Areas such as Rotorua, Tauranga, and Hamilton are examples of thriving towns with these characteristics.

Stay out of areas with aged populations or one-horse towns (towns with only one main employer). Aged populations cause oversupply as the baby boomers disappear. And one-horse towns can be vulnerable to population exodus if the local employer is threatened. Avoid gang infested areas – you can’t collect your rent and may have higher vacancy rates.

TAX DEDUCTIONS ON INTEREST

From April 1, 2025, property investors will once again enjoy 100% deductibility on interest expenses, up from 80% in the 2024–2025 financial year. This policy is a welcome reprieve, supporting landlords in managing rental costs while incentivising housing supply.

The previous non-deductibility policy introduced by the Labour government posed challenges, creating a disincentive for private rental providers, pushing rents up, and threatening the sustainability of the housing market. With full deductibility restored, this rational policy shift encourages investment, helping to stabilise the rental market.

RBNZ's IMPACT ON THE HOUSING MARKET

Reserve Bank governor, Adrian Orr, inflated the housing market with his Covid response and made a huge inflationary mistake, printing too much money and dropping interest rates so low in 2021. His fix has been equally imprudent; he held rates too high for too long, causing structural damage as he fixed his 2021 inflationary mistake. His excuse for the inflation is Covid, and ‘all the other RBs in the world did it’. That’s not an excuse; he should have been more moderate in his supply of cheap money, and he could have brought DTIs in earlier, or yanked LVRs down.

Orr has left New Zealand in dark times, and has tipped acid on the wound by once again over-steering the economy holding rates so high for so long (following keeping them too low for too long).

The only light at the end of the tunnel is that his habit of pushing too hard for too long is likely to be repeated, as he drops rates to respond to the recession he has caused. In this regard, 2025 is looking better, with cheap interest rates and likely a revival of a property sector that is in dire straits for many, especially property developers caught out by the high interest rates.

Debt-to-income ratios

If home prices begin to rise sharply on the back of lower interest rates, the RBNZ may impose debt-to-income (DTI) ratios to moderate borrowing and maintain housing affordability. Investors should keep an eye on this potential policy measure, as it could impact leverage limits in the future. Get your banking facilities in place early; don’t wait, as DTIs could catch you out and constrict your ability to borrow.

DTIs could also have a dampening effect on property values because capital growth will be restricted, at least to a certain extent, by the increase in incomes (with borrowing tied to multiples of how much people earn).

IMMIGRATION

But don’t bet on full recovery yet. It’s not only interest rates that influence the demand for property – immigration is also an important factor.

Immigration has softened in 2024, which poses challenges for the rental market as population growth slows, and this will hold rents and house prices back. The recent dip in immigration, which in mid-2024 was close to breakeven, impacts both housing demand and rental rates, creating a headwind for investors relying on tenant demand and population growth.

Long-term, however, immigration levels are expected to stabilise, especially as the government recognises the need to fill labour gaps and sustain economic growth.

FINAL THOUGHTS

The New Zealand property market in late 2024 is at an inflection point. While Auckland faces oversupply risks and high prices, changing red-zoning and infrastructure costs, regional areas offer promising alternatives with strong rental yields and lower entry costs. Additionally, policy changes, particularly around tax deductions, are creating a more supportive environment for investors.

Staying informed on economic indicators, regulatory shifts, and market-specific factors will be essential to make the most of New Zealand's ever-changing property landscape. Keep an eye on our blogs at www.gra.co.nz where we will update you with the latest changes, and check out our education resources on our web including our Property School and our Tax and Trusts webinar.

Matthew Gilligan

Director

Did you like this article? Subscribe to our newsletter to receive tips, updates and useful information to help you protect your assets and grow your net worth. We're expert accountants providing expert advice to clients in NZ and around the world.

Disclaimer: This article is intended to provide only a summary of the issues associated with the topics covered. It does not purport to be comprehensive nor to provide specific advice. No person should act in reliance on any statement contained within this article without first obtaining specific professional advice. If you require any further information or advice on any matter covered within this article, please contact the author.

Comments

Testimonials

We want to thank you and your team for preparing these accounts for us. We have never been given such a detailed and extensive set of accounts in our lives! We’re very grateful and impressed with the amount of data you and your team have captured, deciphered and presented in such a professional manner. Thanks!

- Al & Michelle, September 2021

Property 101by Matthew Gilligan

Investing in residential property?

Put this at the top of your reading list.

If you're investing in residential property, seeking to maximise your ability to succeed and minimise risk, then this is a 'must read'.

Matthew Gilligan provides a fresh look at residential property investment from an experienced investor’s viewpoint. Written in easy to understand language and including many case studies, Matthew explains the ins and outs of successful property investment.

- How to find the right property

- How to negotiate successfully

- Renovation do's & don'ts

- Property management

- Case studies and examples

- and much, much more...